Budget 2026 has finally been announced! Finance Minister Nirmala Sitharaman ne aaj Parliament mein Budget 2026 pesh kiya, jo unka lagatar 9th budget hai. Is saal ke budget ka total size ₹53.5 lakh crore rakha gaya hai, jisme infrastructure, technology, aur middle-class taxpayers par sabse zyada focus kiya gaya hai.

Agar aap ek salaried employee hain ya business owner, toh Budget 2026 mein aapke liye bohot kuch naya hai. Is article mein hum vistar se baat karenge ki Budget 2026 aapki pocket par kya asar dalega.

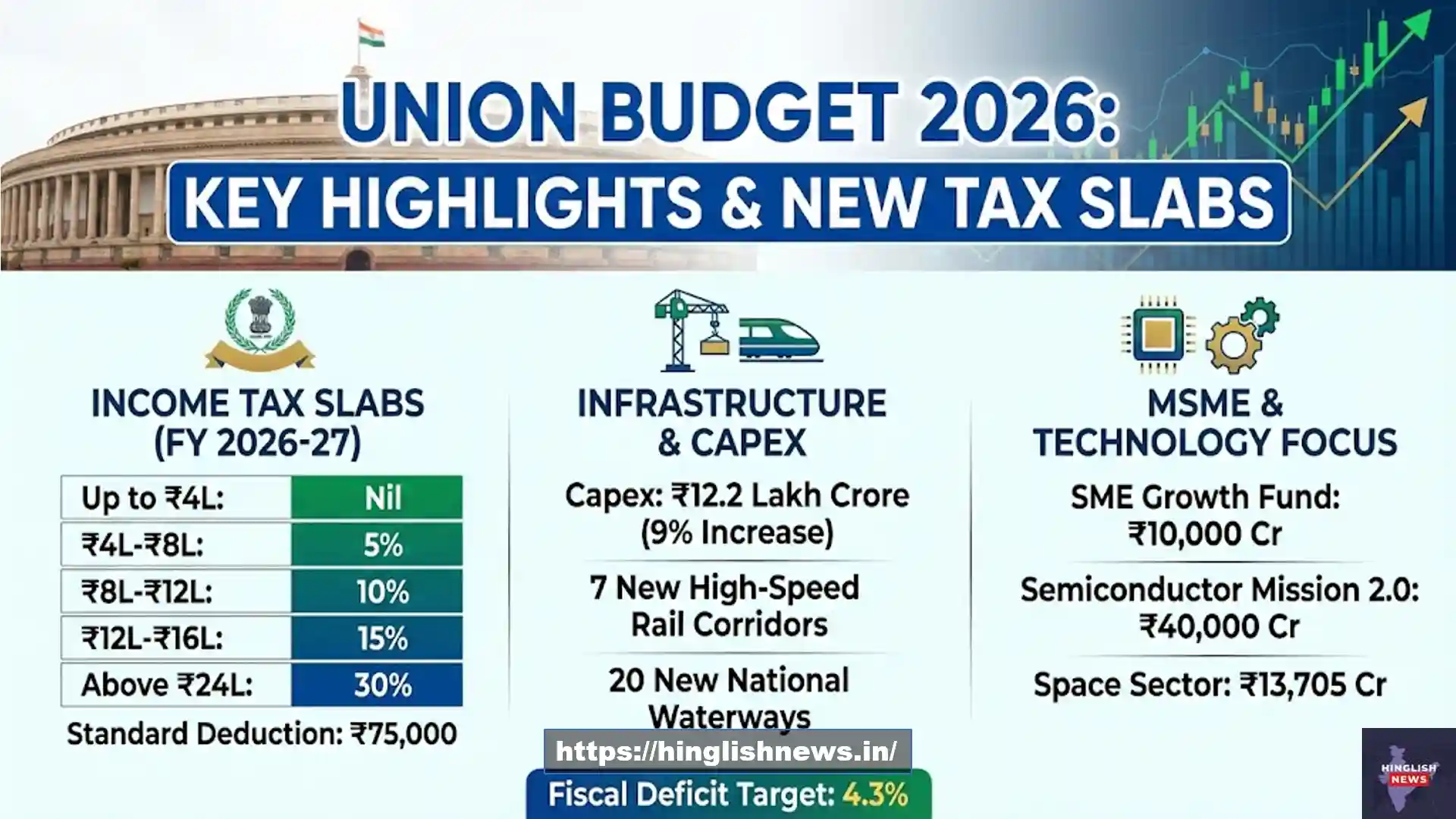

Budget 2026: New Income Tax Slabs aur Badlav

Middle class ke liye Budget 2026 mein sabse bada highlight hai New Income Tax Act ka elaan. Yeh naya act 1 April 2026 se lagu hoga, jiska maqsad tax filing ko aur bhi asaan banana hai.

Sarkar ne tax slabs mein minor adjustments kiye hain taaki logo ke hath mein zyada disposable income bache. Neeche di gayi table mein aap dekh sakte hain ki FY 2026-27 ke liye naye slabs kya hain:

| Income Bracket | Tax Rate |

| Up to ₹4 Lakh | Nil |

| ₹4 Lakh – ₹8 Lakh | 5% |

| ₹8 Lakh – ₹12 Lakh | 10% |

| ₹12 Lakh – ₹16 Lakh | 15% |

| ₹16 Lakh – ₹20 Lakh | 20% |

| ₹20 Lakh – ₹24 Lakh | 25% |

| Above ₹24 Lakh | 30% |

Export to Sheets

- Standard Deduction: Salaried individuals ko ab ₹75,000 ki standard deduction ka fayda milta rahega.

- Section 87A Rebate: Is saal bhi ₹12 lakh tak ki income par koi tax nahi dena hoga, agar aap New Tax Regime chunte hain.

- Foreign Travel (TCS): Overseas tour packages par TCS ko 5-20% ke bracket se hatakar flat 2% kar diya gaya hai, jo travellers ke liye badi rahat hai.

Also Read: UPSC 2026 Application Form: Everything You Need to Apply Successfully

Infrastructure aur Capex: Desh ki Pragati ka Pahiya

Sarkar ne infrastructure development par apna focus barkarar rakha hai. Budget 2026 mein Capital Expenditure (Capex) ko 9% badhakar ₹12.2 lakh crore kar diya gaya hai.

Is investment ka asar seedha desh ki connectivity par padega. Finance Minister ne elaan kiya hai ki desh mein 7 naye High-Speed Rail corridors banaye jayenge, jisme Mumbai-Pune aur Delhi-Varanasi jaise busy routes shamil hain. Saath hi, Dankuni se Surat tak ek naya Dedicated Freight Corridor banaya jayega jo logistics cost ko kam karne mein madad karega.

Waterways par bhi focus badhaya gaya hai. Agle 5 saal mein 20 naye National Waterways develop honge, jo transport ka ek sasta aur eco-friendly medium banenge.

Also Read: CNAP Implementation in India: How Calling Name Presentation Will Stop Fraud Calls

MSME Sector ke liye Nayi Ummeedein

Budget 2026 mein chote udyogo yaani MSMEs ke liye kai scheme announce ki gayi hain:

- SME Growth Fund: ₹10,000 crore ka ek naya fund banaya gaya hai jo un MSMEs ki help karega jo export market mein enter karna chahte hain.

- Self-Reliant India Fund: Micro enterprises ke liye ₹2,000 crore ka extra support diya jayega.

- Corporate Mitras: Tier-2 aur Tier-3 cities mein rehne wale entrepreneurs ke liye “Corporate Mitras” appoint kiye jayenge jo unhe legal aur technical compliance mein help karenge.

Tech aur Manufacturing: Digital India 2.0

Technology ke field mein Bharat ko global leader banane ke liye Budget 2026 mein Semiconductor Mission 2.0 ko launch kiya gaya hai. Iska budget ₹40,000 crore rakha gaya hai.

Iske alawa, Biopharma sector ko boost dene ke liye “Biopharma Shakti” scheme aayi hai, jisme ₹10,000 crore allot hue hain. Odisha, Kerala, Andhra Pradesh aur Tamil Nadu jaise states mein “Rare Earth Corridors” banaye jayenge jo electronics manufacturing ke liye zaroori raw materials ki supply chain ko mazboot karenge.

Space sector ke liye bhi khushkhabri hai. Department of Space ko ₹13,705 crore allot kiye gaye hain, jisse Gaganyaan mission aur naye satellite launches ko tezi milegi.

Investors ke liye Budget 2026 thoda mila-jula raha hai. Securities Transaction Tax (STT) mein badlav kiye gaye hain:

- Futures trading par STT ko badhakar 0.05% kar diya gaya hai.

- Options trading par STT ab 0.15% hoga.

- Share Buybacks: Ab share buybacks se hone wali income ko dividends ki tarah nahi, balki Capital Gains ki tarah tax kiya jayega.

Iske bawajood, digital assets aur data centres ke liye positive news hai. Jo foreign companies India ke data centres use karengi, unhe 2047 tak tax holiday dene ka prastav hai.

Also Read: Govt Notifies New Tobacco Tax: Cigarette Prices to Hike by ₹2-3/Stick, Pan Masala also Hit!!!

Budget 2026 ki summary

Overall, Budget 2026 ek balanced budget dikhta hai. Jaha ek taraf infrastructure aur high-tech manufacturing par zor diya gaya hai, wahi tax slabs mein stability rakhkar middle class ko bharosa dilane ki koshish ki gayi hai. Fiscal Deficit ka target 4.3% rakha gaya hai, jo dikhata hai ki sarkar financial discipline banaye rakhna chahti hai.

Aapko Budget 2026 kaisa laga? Kya naya Income Tax Act aapke liye faydemand hoga? Humein comments mein zaroor batayein.